In poker, the best players don’t win because they chase every hand. They win by playing situations where a small, known loss can lead to a much larger payout.

Investing works the same way. You want to look for asymmetric opportunities where if you lose, you lose small, but if you win, you win big. Let’s talk about how to find and capture those within a larger framework.

Structuring your portfolio

Most investors already have market exposure.

Between 401ks, index funds, and retirement accounts, portfolios are long equities by default. That capital already has a clear role of steadily compounding over time.

A high-growth, asymmetric portfolio sits alongside that core. Its purpose is to create the kind of upside that can materially change outcomes and shorten timelines.

In practice, that usually means something in the 5–20% range of investable net worth, depending on risk tolerance, income stability, and time horizon.

At the lower end of that range, the goal is learning and optionality. You need to have skin in the game to learn how it works. At the higher end, the goal is meaningful upside from a handful of well-structured bets. Pushing beyond that starts to shift the portfolio from asymmetric upside into dependency, which affects behavior and decision-making. If your entire portfolio is in high-growth stocks, the volatility will cause you to make irrational decisions before seeing the true payout at the end.

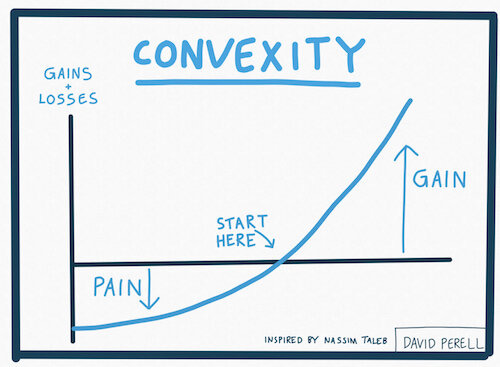

Capturing convexity

In markets, asymmetric payoffs often show up as convexity.

This is where downside is relatively understood while upside remains open-ended and mispriced. These setups often emerge after narratives fade and sentiment moves on, even as execution stabilizes and fundamentals quietly improve. Perception lags reality.

That gap between what the market believes and what is actually unfolding is where meaningful upside can be captured.

A practical example

Take the weekly chart of RIVN, a company we covered in an earlier deep dive.

After years of range-bound action, the stock has started to show signs of life. A long-term bottom is forming and price is starting to press against the top of the range. That’s the point where an idea becomes interesting and risk becomes defined.

In Rivian’s case, strong support formed around the ~$10 level. Using that as a reference point, entering a position here means being comfortable with a 50% drawdown.

That’s the cost of admission for these kinds of setups.

However, if the thesis plays out and Rivian executes through the next product cycle, upside becomes asymmetric. A move back toward prior highs around 180 would represent roughly 800% upside from those levels.

With a $1,000 position, we are risking $500 to potentially make $8,000.

This is how ideas move from interesting to actionable. The downside is understood but the upside is still mispriced.

Timing entries

Asymmetric setups often unfold over long basing periods, which means volatility tends to be high while narratives remain unresolved. Price movement during these phases can feel uncomfortable, but that discomfort is usually part of the setup rather than a signal that something is broken. Smaller sizing allows room for the thesis to develop without forcing a decision too early or creating pressure to be right immediately.

Once a thesis is in place, exposure is generally built during pullbacks rather than strength. While holding individual stocks, it’s not unusual to experience drawdowns of 30% or more. On those days, it’s important not to panic and to remember the plan. As long as nothing has fundamentally changed, red days should be viewed as opportunities to add or do nothing.

Closing thoughts

Asymmetric upside rewards preparation and patience.

Positioning develops over time, with exposure increasing as clarity improves and risk becomes better defined. Volatility creates opportunities rather than forcing decisions.

The objective is to hold the right positions, at the right size, early enough for repricing to matter, while allowing time and structure to do the heavy lifting.

Wait for the market to show its hand, then play your chips with confidence.